GST

GST SETUP

Tax Type Setup

- As the name suggests, this function is used to define the types of tax applied in transactions. In Singapore, these tax types—also known as IRAS Tax Codes—are standardized by the Inland Revenue Authority of Singapore and detailed in the E-Tax Guides available on the IRAS website.

- Common examples of tax codes include: SR, ZR, TX, ZT, etc. (see Fig 1 below). Highnix comes with several predefined tax codes in the default database to help you get started quickly.

- How to use:

- To access this feature, navigate to: System Setup → Company Setup → GST Type Setup (Fig 1)

- To add a new tax type, simply fill out the form located directly below the tax type listing table.

- Note: The same General Ledger (GL) code can be used for both Sales and Purchase accounts, if appropriate.

- To edit or delete, click on the icons on the extremem right.

Tax Group Setup

A Tax Group is used during the setup of customer or supplier profiles. It serves as a way to group multiple tax types (whether for sales or purchases) into a single, manageable entity. This is especially useful when dealing with products or services that are subject to different tax codes.

Highnix's Tax Group feature helps reduce human error by automating tax application during transactions. Since the tax group is assigned at the customer or supplier level by authorized personnel, it prevents users from accidentally selecting incorrect tax types when entering sales or purchase transactions.

How to Use

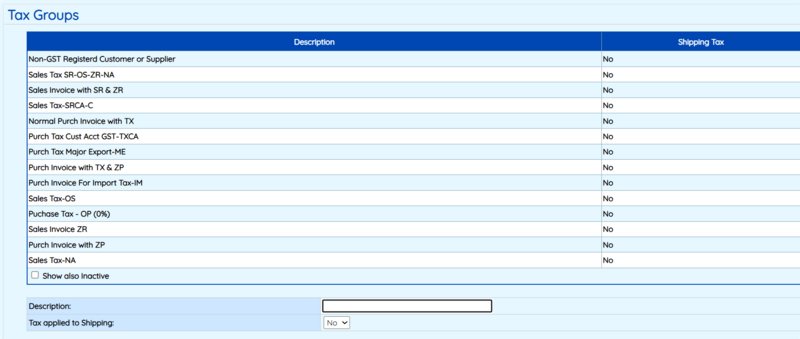

- To access this feature, go to: System Setup → Company Setup → GST Tax Group (See Fig 2)

- To create a new tax group, use the form located below the table.

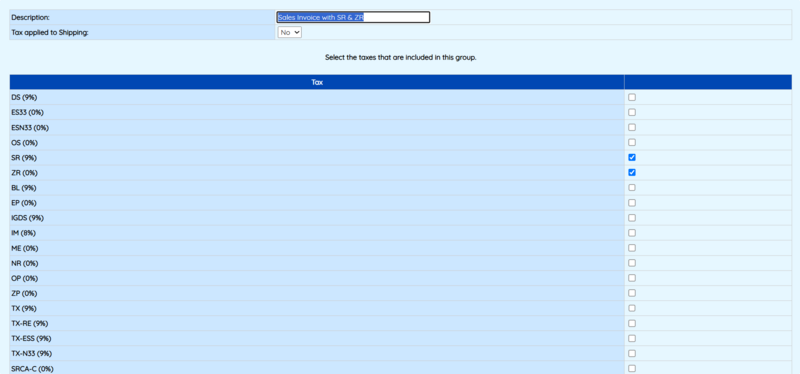

- When creating a new group:

- Enter a meaningful group name.

- Select the relevant tax types to be included in this group (See Fig 3).

- Once the group is created and assigned to a customer or supplier, Highnix will automatically apply the correct tax codes for products that match the group’s tax configuration. This ensures consistency and accuracy in both Sales and Supplier Invoices.

Item Tax Exemption Setup

- This setup is used for products that are "exempted" from tax. It is important for two types of products:

- Products that are exempted from all tax types. When a product is classified for exemption for all taxes, that means, there will be no tax at all. This type of scenario may happen in some countries only.

- Products that are exempted from some tax types. This is a crucial step that product GST should be setup correctly so that the correct GST is applied.

- When used together with Tax Groups, this feature allows invoices to include multiple tax types if they contain products subject to different GST treatments.

- For example, a customer may purchase three products with the following GST breakdown. With item tax exemption configured, an invoice can reflect all three tax types accurately.

- Red Pen – SR @9% GST

- Orange Pen – ZR @0% GST (Zero-Rated)

- Green Pen – NA @0% GST (Not Applicable or Exempt)

- Note: When setup a product item with proper tax type, it is important to setup the item tax correctly. Each product should have 1 GST tax type for Sales and 1 GST tax type for Purchase respectively. Please see below Example 1 for setting up a product with proper Input Tax and Out Tax.

- Another example is a telecommunications bill with different types of GST applied. This can be easily pre-configured, so that future entries follow the defined setup. We will show how taxes can be configured for a telco bill (See "Example: Processing Multiple GST Types in One Invoice" below).

- Overseas calls – No GST

- Local calls – TX @9% GST

Example 1: Setup a product with the proper Input Tax and Output Tax.

- Setup the Tax Types and Tax Groups as described above. We use 3 products, redpen, greenpen and greenpen.

- Identify the tax types of the product for both Sales GST and Purchase GST of ProdA. Assuming that the GST rates are 9% and 0% if GST is not applicable, this rates might be changed over time.

- redpen, Sales GST is SR @9%, Purchase GST is TX @9%.

- orangepen, Sales GST is ZR @0%, Purchase GST is ZP @0%.

- greenpen, Sales GST is NA @0%, Purchase GST is NA @0%.

- Setup an item tax types:

- Give a Tax Name that can easily identify, say "Items Taxable (Sales-Purch) - SR and TX 9%" (this will be used for redpen)

- In the "Is Fully Tax-exempt:" box, select "No".

- in the "Select which taxes this item tax type is exempt from" list, check everything except SR and TX.

- Click on the Add New button.

- Repeat the above steps for ZR/ZP and NA/NA.

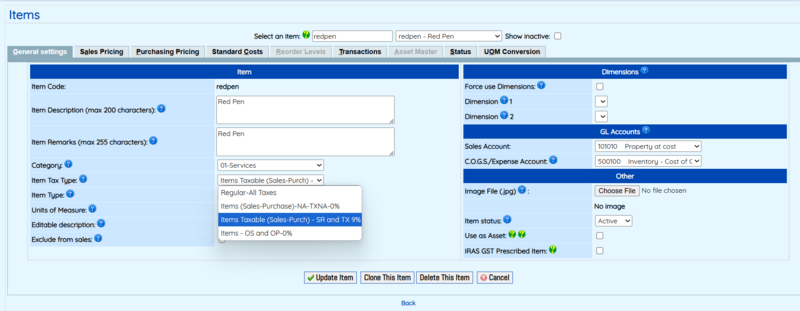

- Go to Inventory Mgt, Maintenance, Add and Edit Items.

- Select the redpen.

- in the Item Tax Type box, from the pull down menu, select the "Items Taxable (Sales-Purch) - SR and TX 9%" created in the above step.

- Click on Update item.

- Repeat for orangepen and greenpen with the corresponding GST Item Tax Types.

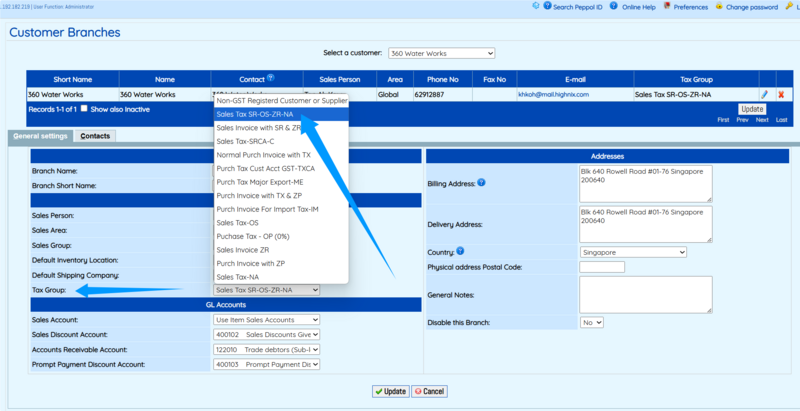

- Under the customer (or supplier) profiles, go to the Sales Mgt, Maintenance, Add and Edit Customer Records, select the customer and go to the branch. Select the branch and then select the correct Tax Group (e.g. "Sales Tax SR-OS-ZR-NA" and click on the Update button.

- When the above steps are completed, now if you process the sales invoice for this customer and the item tax GST type will be applied accodingly.

Example 2: Processing Multiple GST Types in One Invoice

I have a bill from a telco. Local calls are subject to GST, but overseas calls are exempt. These transactions are billed together. How do I set this up and record it?

Highnix ERP can easily handle this common scenario, which is often challenging for users of less flexible systems. In cases where different GST treatments apply within the same bill—such as taxable local calls and GST-exempt overseas calls—Highnix allows for a simple one-time setup. This setup can then be reused across different vendors, customers, and products.

Step 1: Set up a Tax Group

- Go to: System Setup > GST Tax Group.

- Create a new tax group and name it "Purch Invoice with TX & ZP".

- Under "Select the taxes that are included in this group", check the boxes for "TX" and "ZP".

- Save the tax group.

Step 2: Set up an Item Tax Exemption Type

- Go to: System Setup > Item Tax Exemption Type.

- Create a new exemption type named "Items Not Taxable – ZP and ZR 0%".

- Under "Select which taxes this item tax type is exempt from", check all boxes except "ZP" and "ZR".

- Save the exemption type.

Step 3: Set up a Taxable Item Tax Type

- Go to: System Setup > Item Tax.

- Create a new tax type named "Items Taxable – SR and TX @ Prevailing Rate".

- Under "Select which taxes this item tax type is exempt from", check all boxes except "SR" and "TX".

- Save the tax type.

Step 4: Create a Supplier Record

- Go to: Purchase Mgt > Maintenance > Add and Edit Supplier Records.

- Enter the supplier’s name as "Telephone Company".

- In the Tax Group drop-down, select "Purch Invoice with TX & ZP".

- Save the supplier record.

Step 5: Create Product Items

- Go to: Inventory/Product Mgt > Maintenance > Add and Edit Items.

- Create a product named "Local Phone Calls".

- In the Item Tax Type field, select "Items Taxable – SR and TX @ Prevailing Rate".

- Create another product named "Overseas Phone Calls".

- In the Item Tax Type field, select "Items Not Taxable – ZP and ZR 0%".

- Save both products.

Step 6: Enter a Purchase Bill

- Go to: Purchase Mgt > Create Bills.

- Select the supplier "Telephone Company".

- Add both products: "Local Phone Calls" and "Overseas Phone Calls".

- Save the bill.

With this setup, Highnix will automatically apply the correct GST treatment to each item—taxable or non-taxable—within the same invoice.

Note: This configuration can also be used for sales invoices. If you need to invoice both taxable and non-taxable products or services in a single sales invoice, follow the same steps above, but instead of creating a purchase bill, create a sales invoice.

Chnage of GST

Starting year 2024, the GST will be changed from 8% to 9%, how do I go about changing it?Tag:#GST9

The GST rate in Singapore will increase from 8% to 9% on January 1, 2024. GST-registered users can follow these simple steps to change the Sales and Purchase GST from 8% to 9%:

- Go to the System Setup, GST Type Setup.

- Click on edit icon (pencil) on the right of the corresponding tax type. The tax item will appear on the form at the bottom of the listing.

- Change the default rate to 9%.

- Click on the Update button.

- Repeat the above for the rest of the tax types. Note that for 0% tax, user could leave it unchnage.

Note: Highnix ERP records the value of GST at the point when a Sales Invoice (or Purchase Invoice for supplier) is created. If you create a Sales Order or Delivery before the GST rate is updated, you can still change the GST to the correct rate just before the invoices are created.

The next task is to change the descriptions of the tax group and the account descriptions. This is only necessary if the descriptions include the GST rates. For example, if the description of your GST type shows "Normal Sales Invoice with SR-7%", it is best to remove the "-7%" because it is confusing to put the rates there. Similarly, if the description of the account code shows "Output GST Collected-SR-7%", you should remove the "-7%".

To change the description, follow these steps:

- Tax group:

- Go to System Setup > GST Tax Groups.

- Click on the edit icon (pencil) on the right of the corresponding tax group. The tax group details will appear on the form at the bottom of the listing.

- Remove the "-X%" from the description.

- Click on the Update button.

- Repeat the above for the rest of the tax groups.

- Account code:

- Go to Finance Mgt > Maintenance > GL Chart of Account.

- Locate the account code from the drop down menu. (Users can type the account code if they know, the default GST account codes are beginning with "22".)

- Under the Account Name description, remove the rates.

- Click on the Update Account button.