Important Things to Take Note When Sending Invoices to Government

Jump to navigation

Jump to search

Important Notes When Sending Invoices to Singapore Government Agencies (AGD)

When sending invoices to Singapore Government agencies via InvoiceNow, vendors must comply with the following requirements.

Requirements

- Have an active CorpPass account registered at the CorpPass portal (https://www.corppass.gov.sg).

- Have an Approved vendor record in Vendors@Gov (https://www.vendors.gov.sg).

- Before submitting e-invoices to Singapore Government agencies via InvoiceNow, vendors must first create a vendor record in Vendors@Gov.

- Vendors can log in to Vendors@Gov using their CorpPass account.

- The vendor record must be in Approved status before any e-invoice submission is allowed.

- Payments will be made based on the bank account details maintained in the approved vendor record.

- To learn how to log in to Vendors@Gov, please refer to the relevant Vendors@Gov login guide.

- To learn how to create or update a vendor record, please refer to the relevant Vendors@Gov vendor registration guide.

- Ensure that all e-invoices submitted comply with the e-invoice requirements specified by Singapore Government agencies.

Peppol Network Endpoint ID

- When submitting e-invoices to Singapore Government agencies via InvoiceNow, invoices must be sent to the agency’s registered Peppol Endpoint ID.

- You may find the agency’s Peppol Endpoint ID in the Singapore Peppol Directory: here.

- If the agency has not registered a Peppol Endpoint ID, you may submit the e-invoice to the Accountant-General’s Department (AGD) endpoint ID: SGUENT08GA0028A.

- Invoices submitted to the AGD endpoint will be routed to the respective Singapore Government agencies for further processing.

- Vendors will receive invoice status updates from the AGD endpoint. These updates are sent via an Invoice Response document through InvoiceNow.

Government Departments and How to Enter Them in Highnix ERP Customer Profiles

- When supplying products or services to Singapore Government agencies, vendors must correctly identify the Business Unit (BU) code of the agency. While BU information originates from the Vendors@Gov portal, all entries and selections are performed using Highnix ERP terminology and screens.

- Users supplying products or services to Singapore Government agencies must be aware of the relevant Business Unit (BU) codes associated with the agencies they are dealing with.

- A list of the latest Government Ministries and Statutory Boards, including their official BU codes, can be downloaded from the Vendors@Gov website: here.

- The Vendors@Gov portal is used only as a reference source. Users are not required to log in to Vendors@Gov to perform any configuration within Highnix ERP.

- Users supplying products or services to Singapore Government agencies must be aware of the relevant Business Unit (BU) codes associated with the agencies they are dealing with.

- Highnix ERP includes a pre-loaded list of Government Ministries and their corresponding BU codes.

- In Highnix ERP, Government agencies are maintained as Customers, while BU codes are maintained as Customer Branches (Limit to 5 (five) Characters).

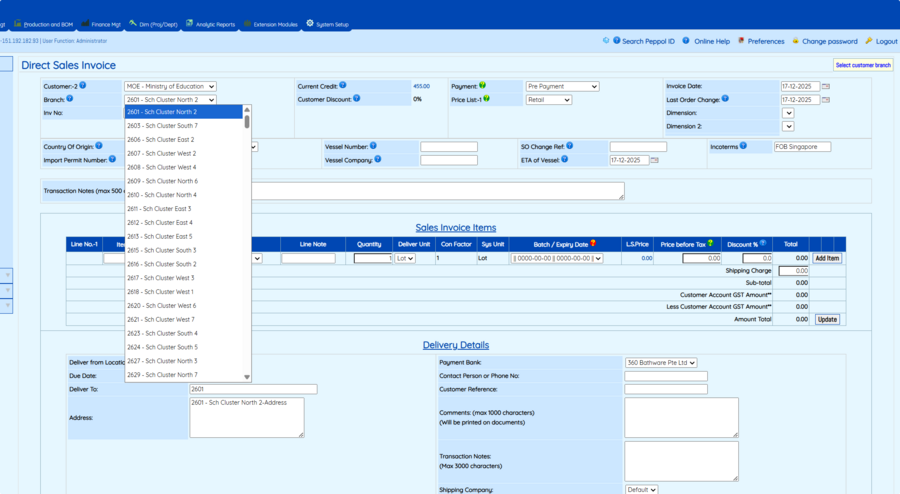

- When creating a Sales Order, Delivery, or Invoice, users should first select the relevant Government Ministry in the Customer field.

- After selecting the Customer, users can choose the appropriate BU code from the Branches drop-down list (see Fig. 1).

- The selected BU determines the billing address, contact details, and routing information used for InvoiceNow submission.

- Note on BU Maintenance and Updates

- Users are advised to review BU details, such as address, department name, and contact information, at least once every two months to ensure accuracy.

- The Government contacts

- Changes in BU details may occur due to internal restructuring within Government agencies.

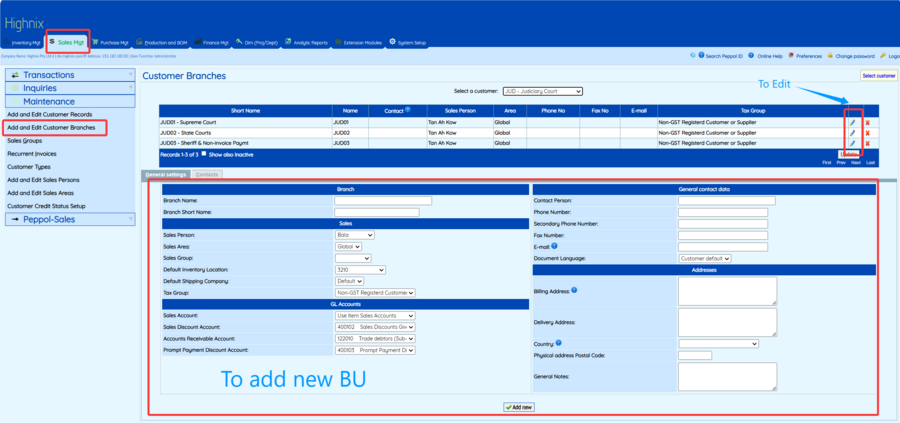

- To review or update BU details in Highnix ERP, navigate to Sales Management → Maintenance → Add and Edit Customer Branches (see Fig. 2).

- Select the relevant BU and click the pencil icon to edit existing details.

- To add a new BU, complete the form on the same page and click the Add New button.

- Common Mistakes and Tips

- Do not confuse Ministry names with BU codes. A single Ministry may have multiple BU codes, each representing a different department or division.

- Do not create duplicate customers for the same Ministry. Always use the existing Customer record and add or select the correct BU under Customer Branches.

- Ensure the correct BU is selected before invoice submission. An incorrect BU may result in invoice rejection or delayed processing by the Government agency.

- Avoid using free-text entries for BU-related information. Always select from the predefined Branch list to ensure consistency and compliance.

- Verify BU details regularly, especially if invoices are rejected or queried due to address or department mismatches.

- Best Practice Recommendation

- Assign a responsible user to manage and periodically review Government BU records in Highnix ERP.

- Maintain a simple internal reference list mapping your customers’ projects or contracts to the corresponding BU codes for ease of use.

AGD Requirement and Size Limitations

- The table below outlines the Government Procurement (AGD) requirements for Invoice documents. Please take note of the specific requirements and size limitations for each field. As the requirements for B2B and B2G transactions differ, the Highnix system adopts the higher field length where applicable. For example, the Business Unit field allows up to 5 characters for AGD transactions, whereas B2B transactions require up to 100 characters. In such cases, the field size in Highnix is set to 100 characters. If the entered value exceeds the defined limit, the invoice will be rejected.

| No | Field | Requirements |

| 1 | Business Unit | The Business Unit, which is a maximum 5-character code, must be based on this list. To know which Business Unit to indicate, please enquire with your client agency. |

| 2 | Attention To | Maximum 20 characters. Limited set of acceptable characters. |

| 3 | Invoice Number | Maximum 27 characters. Cannot contain space. Limited set of acceptable characters. |

| 4 | Invoice Date | Cannot be backdated by more than 7 calendar days or forward-dated. |

| 5 | Vendor ID | Based on the vendor record created at Vendors@Gov. Vendor status must be “Approved”. If you have multiple Vendor IDs, they must be tagged to your CorpPass Entity ID1. |

| 6 | Email Address | If you do not have a registered vendor record, your e-invoice will be rejected and a notification will be sent to this email. |

| 7 | Invoicing Instruction ID/Purchase Order ID | To find out whether you need to bill against an Invoicing Instruction(II) / Purchase Order(PO), please enquire with your client agency. If there is no II/PO, please omit this field in the invoice. |

| 8 | Payment Terms | Based on the agreed payment terms with your client agency. Refer to this list of acceptable payment terms. |

| 9 | Currency | Refer to this list of acceptable currencies. |

| 10 | Invoice Description | Maximum 254 characters. |

| 11 | Related Invoice ID | *Mandatory for credit notes – To indicate which credit note is meant to offset. |

| 12 | Maximum 30 characters. Cannot contain space. Limited set of acceptable characters. | |

| 13 | Remit To Vendor ID | Applicable only to vendors with multiple vendor IDs who wish to receive payment in the bank account registered with another Vendor ID. To indicate the Vendor ID for the receiving bank account. |

| 14 | *Mutually exclusive with Factoring Company | Your Remit To Vendor ID must also be tagged to your Invoicing Vendor ID1. |

| 15 | For reference, please see Annex 1. | |

| 16 | Factoring Company | To indicate the Vendor ID of your Factoring Company. To find out the Vendor ID of your Factoring Company, please enquire with your Factoring Company. If you wish to add a Factoring Company to the list, please submit a ticket at AGD Helpdesk, before you submit the factored invoice. |

| 17 | *Mutually exclusive with Remit To Vendor ID | Before submitting an e-invoice with a factoring arrangement, please inform your client agency. |

| 18 | If your e-invoice is factored, do indicate the invoice code as “393” in cbc:InvoiceTypeCode. | |

| 19 | Sub Total | Gross amount should be equal to the sum of the invoice line amounts. Prepaid amount and payable rounding amount are not acceptable. |

| 20 | (Excluding GST) | |

| 21 | Total GST Amount | If the e-invoice contains GST Amount, the GST registration of your vendor record created at Vendors@Gov should be “Yes”. |

| 22 | Total Freight Amount | The only allowable charge is Freight. If you need to bill for other charges/allowances, please indicate them as individual e-invoice line items instead of under the charge/allowance segment of the Peppol e-invoice. |

| 23 | Freight can only be billed as a charge at the invoice header level, and not the invoice line level. | |

| 24 | Note: cac:AllowanceCharge\cbc:ChargeIndicator: “True” | |

| 25 | cac:AllowanceCharge\cbc:AllowanceChargeReasonCode: | |

| 26 | “FC” | |

| 27 | Invoice Line Number | For e-invoices billed against Invoicing Instruction(II) / Purchase Order(PO), the Line Number of the II/PO should be captured in the e-invoice and sent using the OrderLineReference field. |

| 28 | Maximum 5 characters. | |

| 29 | Invoice Line Description | For e-invoices billed against Invoicing Instruction(II) / Purchase Order(PO), the Invoice Line Description should match the line description of the II/PO. |

| 30 | Maximum 254 characters. | |

| 31 | Unit Price for Invoice Line | For e-invoices billed against Invoicing Instruction(II) / Purchase Order(PO) and are billing for services, the Unit Price and Quantity should swop. |

| 32 | What This Means: | |

| 33 | Unit Price: Set the Unit Price to 1. | |

| 34 | Quantity: Set the Quantity to the value that was originally intended for the Unit Price. | |

| 35 | Quantity for Invoice Line | This rule is designed to standardize the invoicing process for services, ensuring clarity and consistency in billing. |

| 36 | Invoice Line Amount | Sum of Invoice Line Amounts must be equal to Invoice Total Amount. |

| 37 | (Excludes GST) | |

| 38 | All Invoice Line Amounts must be of the same currency. | |

| 39 | Invoice Line GST Treatment | For customer accounting, all invoice lines must have the same treatment. Invoices for items subject to customer accounting should be separately submitted from invoices for standard-rated and zero-rated items. |

| 40 | For details on customer accounting, you may refer here. | |

| 41 | Attachment File Name | - |

| 42 | Attachment Document | Only 1 attachment is allowed per e-invoice. |

| 43 | Acceptable formats: BMP, GIF, JPEG, JPG, PDF, PNG | |

| 44 | Maximum file size: 1MB per attachment |

Receiving Invoice Responses from Government Agencies or Customers

- Customers, including the Accountant-General’s Department (AGD) and other IMDA-accredited systems, are able to send invoice responses to the Highnix ERP system.

- The following invoice response codes may be received:

- AB – Message Acknowledged

- IP – In Process

- UQ – Under Query

- CA – Conditionally Accepted

- RE – Rejected

- AP – Accepted

- PD – Paid

- Each response code represents a specific invoice status. These responses may be sent by customers at different stages of invoice processing.

- For more details, please refer to Receiving Invoice Response from Customer.

For additional clarity, please search online using the keywords "User Guide for Government Vendors on InvoiceNow" and refer to the latest official documentation for detailed step-by-step instructions.

Go to the next topic: Send Invoices to Government